Is there more than one Credit Reference Agency? (CRA).

The UK has three main CRAs namely Experian, Equifax and TransUnion.

What is a good credit score?

Each CRA has its own credit scoring system and therefore there isn’t one answer to ‘what is a good credit score?’

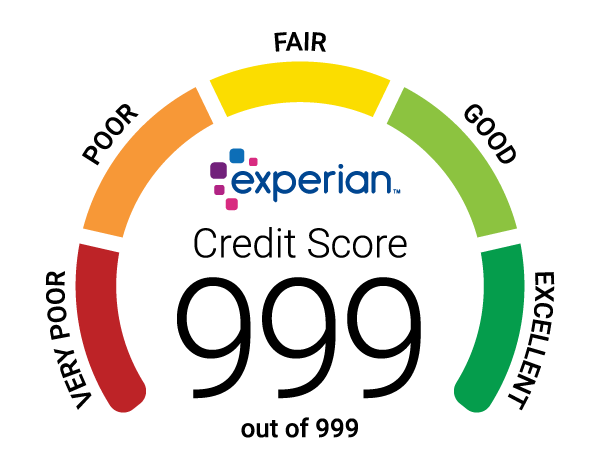

1. Experian

The Experian score runs from 0-999 with 999 the maximum score you can receive.

2. Equifax

The Equifax score is out of 1,000 and their scoring system falls into five bands:

| What your score means | Equifax Score | ||||

|---|---|---|---|---|---|

| Poor | 0 to 438 | ||||

| Fair | 439 to 530 | ||||

| Good | 531 to 670 | ||||

| Very Good | 671 to 810 | ||||

| Excellent | 811 to 1000 |

3. Transunion

The TransUnion score is out of 710 and they also split their scoring into five bands:

| What your score means | TransUnion Score | ||||

|---|---|---|---|---|---|

| Very poor | 0 to 550 | ||||

| Poor | 551 - 565 | ||||

| Fair | 566 - 603 | ||||

| Good | 604 - 627 | ||||

| Excellent | 628 - 710 |

Does a good score mean I will get that loan or credit card?

Unfortunately not. Lenders do take their information from the CRAs, but they also have their own system of scoring. This means one lender may choose to accept you and another lender may not. Also, a lender may use one, two or even all three CRAs to help make their decision. Credit scores from each CRA help give you an idea of how a lender might view your application but an excellent score with one CRA doesn’t guarantee your application for credit will be successful.

How to improve your credit score

A credit score is constantly changing and lots of factors can impact this. Some basic things you should do are:

- If you have any credit (e.g. a credit card or loan) make sure you don’t miss any payments.

- Ensure you’re on the Electoral Register

- If you receive a County Court Judgment (CCJ), it will be marked as ‘Set Aside‘, if you pay it within one calendar month and it will be removed entirely from your credit report. If you don’t, a judgment will be on your credit report for six years from the date of order.

- Ensure your rent payments are added to your credit file. CreditLadder is the first way in which your rent payments can be added to your Experian, Equifax and TransUnion credit files. On time rent payments can increase your Equifax and TransUnion credit score, and will also appear on your Experian credit report where lenders can see you make regular payments.

Which CRA should I use?

As an individual you don’t actually use a CRA. In general, all the CRAs will hold some information on you, and lenders will often use two, if not all three CRAs when making a lending decision. For that reason, it’s important that you are seen in the best possible light by all three CRAs and don’t try to just focus on one CRA.

What about the credit scores I can get from elsewhere?

Lots of companies give you access to a credit score, but did you know that these credit scores all come from one of Experian, Equifax or TransUnion? The table below shows some of the companies who provide credit score information, and also from which CRA they get this from:

| Credit Monitoring Services |  |

||||

|---|---|---|---|---|---|

| checkmyfile |

|

|

|

||

| ClearScore |

|

||||

| CredAbility |

|

||||

| Credit Karma |

|

||||

| Experian CreditExpert |

|

||||

| Equifax Credit Report & Score |

|

||||

| MoneySupermarket |

|

||||

| Money Saving Expert (MSE) Credit Club |

|

||||

| TotallyMoney |

|

||||

| TransUnion Credit Report |

|

||||

As you can see these companies provide credit scores from all the CRAs, with TransUnion being the main one.

In summary, there is no one universal credit score in the UK - the three main credit reference agencies all provide a scoring system that lenders use to decide whether or not they will lend to you - this includes for loans, credit cards and also mortgages. It’s important to keep your score as good as possible and for lenders to see you in the best possible light. If you are renting, then ensuring your rent payments are reported to all three CRAs is hugely important and CreditLadder is the only way you can do this.