Up to £1,500 available depending on personal circumstances

With inflation at its highest in over 40 years and the Bank of England base rate increasing three times this year, not a week passes without the cost of living going up. Unfortunately, further increases in the cost of living are on the way with the energy price cap due to increase in October and January.

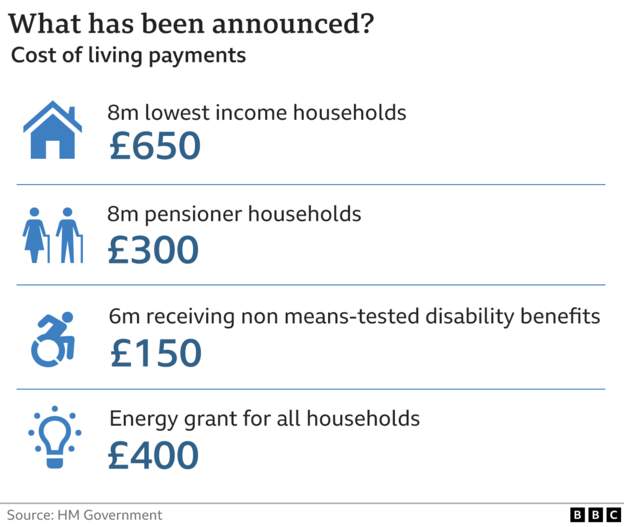

Cost of living payment - worth up to £650

- 8 million low-income households who receive Universal Credit, tax credits, pension credit and other means-tested benefits will receive payments of £650. This payment will be made straight into bank accounts. The first payment of £326 was made in July 2022, and a second instalment will be transferred in the Autumn.

- Those on disability benefits will receive £150 in September 2022 which may be on top of the £650 mentioned above..

- If your household has at least one person of pension age, you will also receive an extra £300 in either November or December 2022.

- Importantly, if you qualify for these payments, it will not count towards any benefit cap nor impact any existing benefit awards.

Get £400 off your Energy Bills this Autumn

One payment every household will qualify for is a £400 energy bill discount - irrespective of their income or savings. The energy discount will start in October 2022 and will be applied for 6 months. If you have a domestic electricity meter point then you will automatically receive a deduction on your bill if you pay via payment cards, standard credit or direct debit. If you use a prepayment meter then you will be provided with discount vouchers in the first week of each month. It is therefore important that your details are up to date with your utility supplier.

Do I need to pay back the £400?

No, there is no requirement to pay the £400 back.

Who gets the savings if I am in a flat or house share?

The savings will come straight off the energy bill so the actual bill will be lower. That means when it comes to paying for your share of the bill, the bill will be £400 lower meaning your share will also be lower.

Summary

Whilst the help available will make a difference, the average energy bill is likely to be over £2,000 more expensive this winter than last winter. If you are struggling, all the big utility companies have hardship funds and you can also get advice from organisations including Citizens Advice, Turn2Us or the StepChange debt charity.

CreditLadder can help you improve your credit score

If you want to improve your credit position by reporting your rent payments, CreditLadder is the only way to improve your credit score and position across all four of the main Credit Reference Agencies in the UK, namely Experian, Equifax, TransUnion and Crediva. Building up a high credit score has a lot of benefits, including helping you access finance at better rates - this can also help save you money.

CreditLadder also runs a free mortgage application service in partnership with Tembo which will tell you how much you could borrow.

Remember the information provided in this article is for information purposes only and should not be considered as advice.